Consider This Before Hiring a Collection Agency.

Can third-party commercial debt collection agencies collect more for your organization? The answer is a resounding yes! With potential decreased operating costs and less overhead, outside help can be a viable and attractive option for many organizations over utilizing more expensive internal resources.

Essentially, your goal in evaluating and selecting a third-party agency to collect on your business debts should be to answer the question – “Does the agency have the infrastructure, systems, people, and processes in place to collect efficiently and effectively on my portfolio to maximize return?”

Burt & Associates meets all of these criteria. With state-of-the-art technology, resources, well-trained seasoned professionals, and consistent adherence to debt collection laws, Burt & Associates is a logical choice. As members of ACA International, The Commercial Law League of America (CLLA), an INC. 500 recognized company and SAS70 Type II Certification; you can depend on us to handle your business as you would handle it.

Commercial Collection Topics

- What Drives a Debt Collector? The unsung heroes of business owners. What motivates a debt collector? Debt collectors provide a valuable service that keeps a...

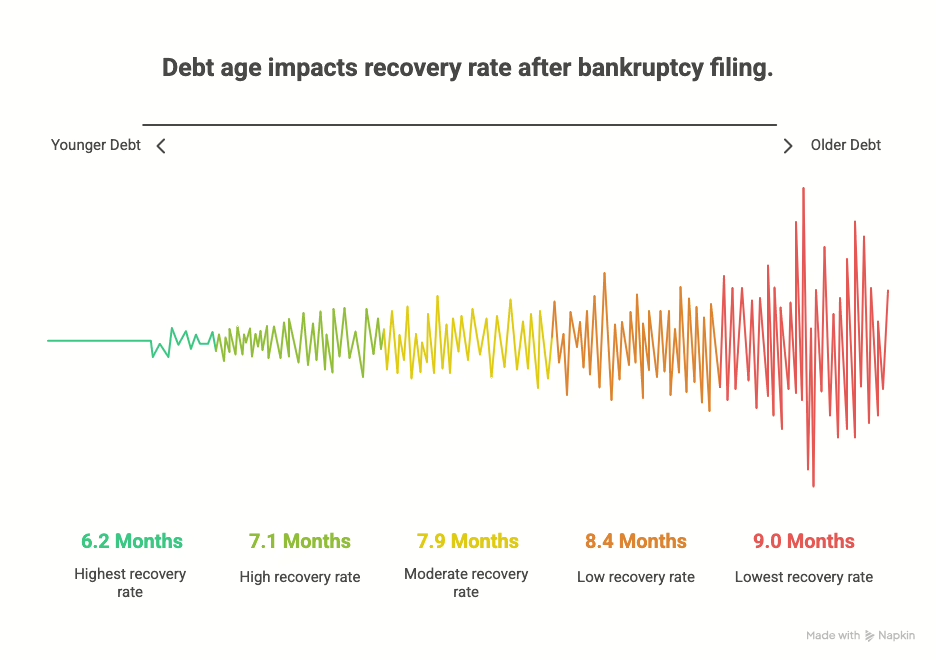

- Voluntary Repayment of a Bankruptcy Discharged Debt Discusses a debtor's choice to repay a bankruptcy discharged debt....

- Top 3 things to consider when placing accounts for commercial collections Top 3 things to consider commercial debt collection; Getting Paid!, Protecting Your Company’s “BRAND” and Licensing, Bonding, and Insurance...

- What The Recent Rise in Bankruptcies Means For You Just because bankruptcies are on the rise doesn’t mean you have to let your debts go unsettled. This article to...